Commercial

- Specialist Mortgage Advisers

- Thousands of Mortgage Products Available

- See if we can help you find the right deal.

Get in touch for a, no-obligation chat with an adviser about how we might be able to help.

Your home may be repossessed if you do not keep up repayments on your mortgage

Table of Contents

Get advice

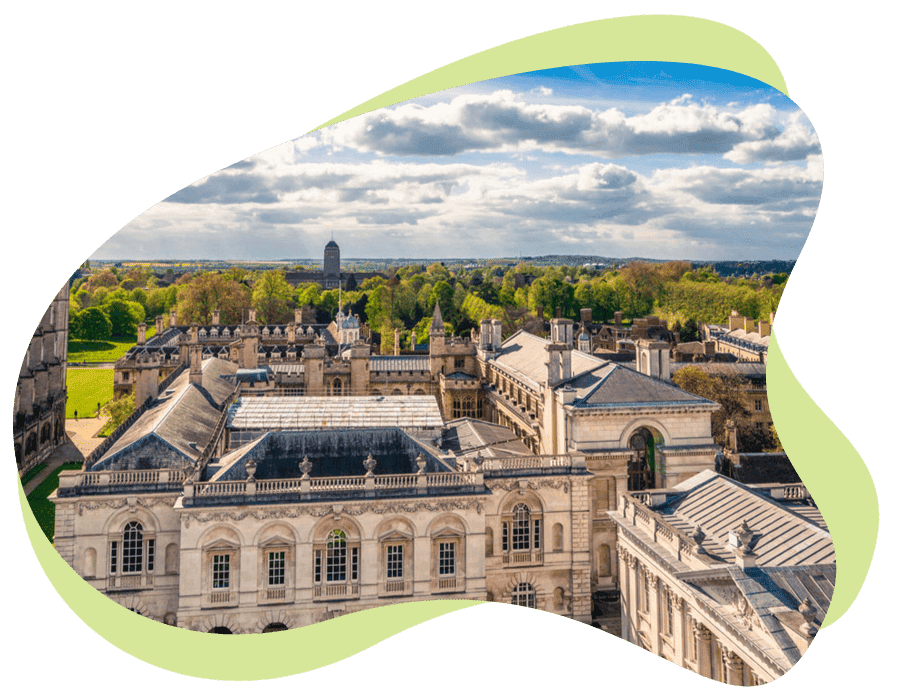

Limetree Financial Services, based in Cambridge, have over 75 years’ industry experience offering advice on the insurance and mortgage markets. Regardless of whether you are an experienced business person in need of a commercial mortgage or a first time buyer, we have the team to help get the best deal on the market suited to your needs. Read our client testimonials to learn more about how we work.

Whether you need a mortgage for a hotel, farm, factory, pub or restaurant, there will be a financial solution for you. Despite the difficult economic climate it’s essential to use a professional service that you can trust to help you find and negotiate the best package. As we are regulated by the Financial Conduct Authority you can be certain that we will act with your best interests at all times.

We pride ourselves on good communication and our open and honest approach. Every client has differing needs that’s why we offer a personal service, individual to their requirements. We also understand that life is busy and our team happily work outside the normal 9-5 so we can fit around your meetings and commitments. Ensuring high levels of customer service is vital to maintain the quality service that our clients expect from the team at Limetree Cambridge.

So if you have a dream about launching a new business and want to discuss your financial requirements then please don’t hesitate to contact our team of experts, we will be happy to help you on your way to achieving your goals.

We are unable to provide you with advice on commercial mortgages. However, we can introduce you to an authorised and regulated Financial Adviser who can provide you with specialist advice

What our clients say…

Contact Us

So if you would like to discuss how we help you then give our friendly Cambridge team a ring today on 01223 266140.